An SIP (Systematic Investment Plan) calculator is an online tool designed to help investors estimate the potential returns from their mutual fund investments. It also assists in determining how much to invest each month to achieve specific financial goals.

To use an SIP calculator, you’ll typically need to provide the following details:

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram

- The amount you plan to invest monthly

- The duration of your investment

- The expected rate of return

Based on this information, the calculator offers an estimate of the total amount you could accumulate over the specified time frame.

SIP calculators are especially useful for planning major financial milestones, such as buying a home, purchasing a car, or funding a child’s education. However, it’s important to remember that actual returns may differ, and the calculator does not account for factors like entry and exit loads.

How SIP Calculator Works

SIP calculators are designed to calculate the monthly SIP amount using a straightforward formula. Here’s how it works:

- Calculating Monthly SIP Contributions: The calculator prompts you to enter details such as your target corpus (final amount you want to accumulate), the number of years you plan to invest, and the expected rate of return. Based on this information, the SIP calculator calculates how much you need to invest each month to achieve your financial goal.

- Calculating the Growth of SIP Investments: Once you input the monthly SIP amount, the investment tenure, and the expected rate of return, the calculator estimates the total amount you will accumulate by the end of the investment period.

How to Use a Systematic Investment Plan Calculator

A SIP calculator can be used in different ways, such as:

- Determining Monthly SIP Contributions: Helps you figure out how much you need to invest every month to reach your financial goal.

- Calculating Total Accumulated Amount: Estimates the total amount accumulated at the end of the investment period, considering your monthly contributions and expected returns.

- Identifying the Required Rate of Return: If you know your target corpus and investment tenure, the calculator can also help you determine the annual return rate you need to achieve your goal.

To get accurate results from an SIP calculator, it’s essential to provide relevant and accurate information. This ensures the calculator can generate precise estimates to guide your investment planning.

Benefits of Using an SIP Calculator

An SIP Calculator offers several key benefits that can help you optimize and streamline your investment strategy:

- User-Friendly: The SIP calculator is designed to be easy to use, allowing you to adjust parameters such as monthly contributions, investment duration, and expected returns to tailor your investment plan. It simplifies complex calculations and makes the process more accessible.

- Instant Projections: With an SIP calculator, you can quickly estimate the future value of your investment. It provides accurate projections, helping you understand how your SIP can grow over time based on your chosen parameters.

- Informed Investment Decisions: By using the SIP calculator to project the future value of your investments, you can make more informed decisions about your financial strategy. It allows you to evaluate different investment scenarios, aiding in strategic financial planning.

- Reduced Complexity: The SIP calculator saves time by automating the complex calculations involved in SIP planning. This makes it easier for you to analyze potential returns without needing to manually calculate each aspect of your investment.

- Free of Cost: Most online SIP calculators are available free of charge, providing an easy and cost-effective way to determine how much you need to invest to reach your financial goals.

Overall, the SIP calculator is a valuable tool for both novice and experienced investors, helping them plan, project, and optimize their mutual fund investments with ease.

Types of SIP Calculators

Type 1: To know how much return for our SIP

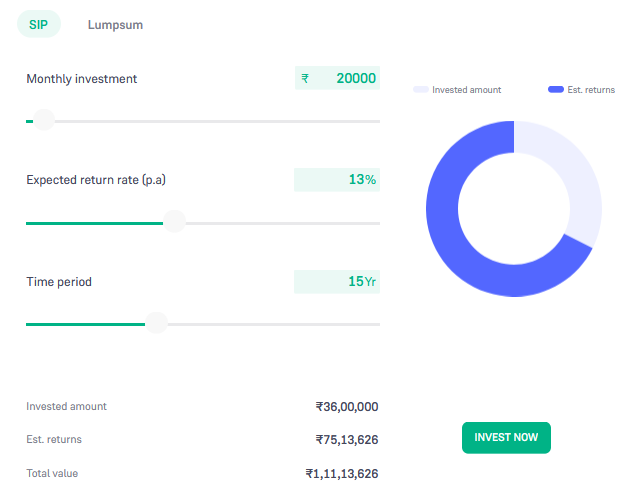

Investing: If you are going to invest 20,000 rupees on monthly basis on SIP for next 15 years @ 13% interest.

Result: After 15 years you will get 1,11,13,626 rupees. (approx.)

Type 2: To know the investing amount for SIP

Investing: If you need 50,00,000 rupees in next 10 years.

Result: You need to invest 9,643 (approx.) rupees on monthly basis on SIP for next 15 years with assuming 13% interest rate.

Type 3: To Know the tenure of our SIP

Investing: If you need 50,00,000 rupees, and investing 30,000 rupees monthly SIP with 13% interest rate.

Result: You need to invest 9 years to achieve this desired amount.

Type 4: Stepping-up the investment amount

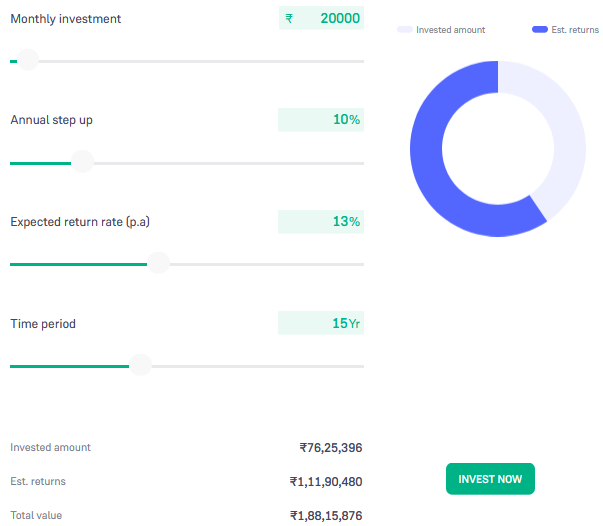

Investing: If you are going to invest 20,000 rupees on monthly basis on SIP for next 15 years @ 13% interest with yearly step up of 10% of your investment.

Result: After 15 years you will get 1,88,15,876 rupees. (approx.) With stepping up 10% annually you will get extra ( 1,88,15,876 – 1,11,13,626 = 77,02,250 ) rupees.

All values and calculations are based on assumptions. Please consult with your financial advisor before making any investment decisions based on this article. Thank you for reading, and we look forward to sharing another interesting article with you soon!

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram