You Won’t Believe How Much You’ll Save After RBI’s Latest Repo Rate Cut The Reserve Bank of India (RBI) has cut the RBI repo rate cut by 50 basis points (0.5%), which is great news for home loan borrowers. If you have a repo-linked home loan (RLLR), your EMIs could...

Finance

Invest ₹1,000 Today—See How Much You Get with Kisan Vikas Patra

Invest ₹1,000 Today—See How Much You Get with Kisan Vikas Patra The Kisan Vikas Patra (KVP) is a small savings scheme offered by India Post designed to encourage long-term financial planning. It guarantees a fixed interest rate and allows investments to double within...

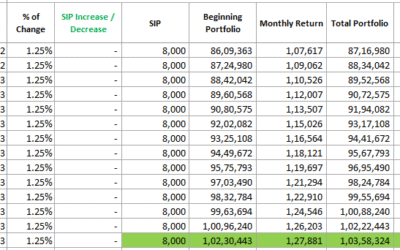

You Won’t Believe What 8,000 Monthly SIP Can Grow Into 1 Crore

You Won’t Believe What 8,000 Monthly SIP Can Grow Into 1 Crore Do you dream of having a big retirement fund? What if we told you that investing just ₹8,000 every month can help you build a huge ₹1 crore corpus over time? Yes, it’s possible — all thanks to the power of...

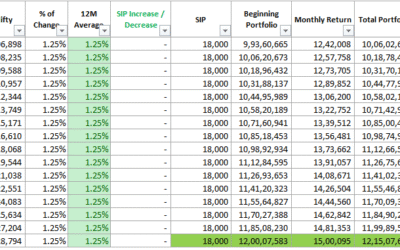

You Won’t Believe 18,000 Monthly SIP Can Grow Into 12 Crore!

You Won’t Believe 18,000 Monthly SIP Can Grow Into 12 Crore! Do you dream of having a big retirement fund? What if we told you that investing just ₹18,000 every month can help you build a huge ₹12 crore corpus over time? Yes, it’s possible — all thanks to the power of...

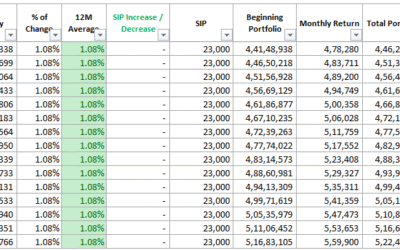

Plan Your ₹5 Crore Retirement with Just ₹23K SIP – Here’s How

Retirement : Do you how much amount you have to invest to get a retirement amount of 5 Crore? Retirement planning is a process of setting up a goal for your life after you stop working and creating financial strategy to reach those goals. It includes saving money,...

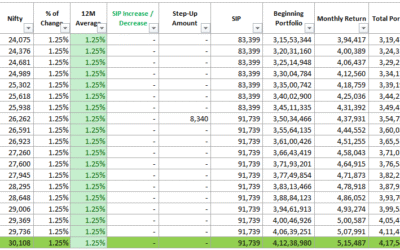

How much you get after 20 Years, if you made Step-up SIP

Do you how much amount you will get after 20 years by increasing your monthly SIP amount? If you have a SIP setup for 15,000 per month, you can invest it smartly to get a steady income every month for years. Let’s understand how a mutual fund and Systematic Investment...

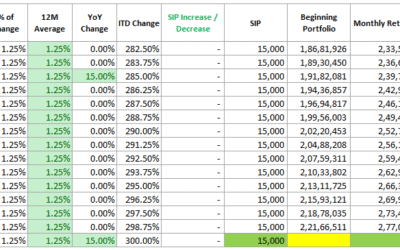

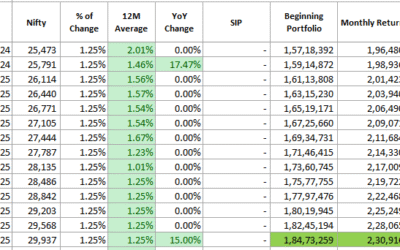

How much you will get after 20 Years, if you made 15,000 Rs as SIP

Do you how much amount you will get after 20 years by investing 15,000 as monthly SIP? If you have a SIP setup for 15,000 per month, you can invest it smartly to get a steady income every month for years. Let’s understand how a mutual fund and Systematic Investment...

You Won’t Believe What Rs 13 Lakh MF Investment Can Turn Into in 20 Years

Do you how much amount you will get after 20 years by investing One-Time Investment of Rs 13 Lakhs? Are you wondering how to turn your savings into regular monthly income? If you have a lump sum amount like Rs 13,00,000, you can invest it smartly to get a steady...

How to Grow Your Money with Mutual Funds in Simple Steps

How to Grow Your Money with Mutual Funds in Simple Steps For those new to investing, figuring it out can be a bit challenging at first. However, mutual funds are an easy and smart option for you to try. If you are saving up for the future or want your savings to grow,...

SBI, PNB, HDFC New Minimum Balance Rules 2025 – Avoid Penalties

The new rules are that from the 1st of April 2025 SBI, PNB, and HDFC like many other banks will review their minimum balance rules. All these changes will impact customers within urban areas, rural areas and other incorporated places. The new measures therefore apply...

Which Insurance Companies Settle Claims Fast? IRDAI 2025 Data Revealed

The Irony of claim settlement is the latest information that has been coming out in the recent publication of the insurance statistical bulletin of IRDAI (Insurance Regulatory and Development Authority of India) 2025. According to the said report, Acko General...

How to Choose the Best Health Insurance Plan for Your Needs

How to Choose the Best Health Insurance Plan for Your Needs A person may experience overwhelming feelings when trying to understand health insurance details so let's simplify the process now. Knowing how your health insurance works enables you to save money and access...

PM Kisan 19th Instalment: Release Date, Eligibility & Status

PM Kisan 19th Instalment: Release Date, Eligibility & Status The Pradhan Mantri Kisan Samman Nidhi (PM KISAN) scheme is one of the most significant government initiatives aimed at supporting farmers financially. This scheme, launched in February 2019, provides...

Ayushman Bharat Yojana: Apply for Ayushman Card Online & Check Eligibility

Ayushman Bharat Yojana: Apply for Ayushman Card Online & Check Eligibility The Ayushman Bharat Yojana (PMJAY) is a government healthcare scheme that provides free medical treatment up to ₹5 lakh per year for eligible individuals at empaneled hospitals. If you...

New Banking & ATM Rules from Feb 2025: UPI, Gas, Car Prices Updated

New Banking & ATM Rules from Feb 2025: UPI, Gas, Car Prices Updated Starting February 1, 2025, several financial and economic changes have come into effect, impacting everyday transactions. These changes include higher ATM withdrawal charges, updated UPI...

SBI Fixed Deposit Rates for Senior Citizens: Returns on ₹1 Lakh Investment

SBI Fixed Deposit (FD) Rates for Senior Citizens: Check Returns on ₹1 Lakh Investment Want to earn higher returns on your savings? SBI offers special FD rates for senior citizens with guaranteed growth. Check the latest interest rates and see how much you can earn on...

E Newsletter

Sign up for our email newsletter to stay up to date.

We will never send any spam emails. Promise.