From Gaming to AI: How Nvidia is Dominating the Tech Landscape

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram

Record-Breaking Financial Performance

- Revenue Surge: Nvidia reported $35.08 billion in revenue for Q3 FY2024, a 94% increase from $18.12 billion in the same quarter last year.

- Earnings Growth:

- Net income more than doubled to $19.31 billion from $9.24 billion a year ago.

- Adjusted earnings per share (EPS) rose to 81 cents, beating analysts’ expectations of 75 cents.

- Forecast: Nvidia projects Q4 revenue of $37.5 billion (±2%), slightly exceeding analysts’ estimates of $37.09 billion.

AI Boom Fuels Growth

-

- Data Center Dominance:

- Revenue surged 112% YoY to $30.8 billion, driven by robust demand for AI chips and networking components.

- Hopper and Blackwell computing platforms played pivotal roles, enabling advanced AI applications like large language models and generative AI.

- Customer Adoption: Major tech firms like Microsoft, Oracle, and OpenAI have begun deploying Nvidia’s next-generation Blackwell AI chips.

- Data Center Dominance:

Challenges Amid Success

- Supply Constraints:

- Production of Blackwell chips will begin in Q4 FY2025, ramping into FY2026. Demand is expected to exceed supply for several quarters.

- Hopper and Blackwell systems are both facing supply shortages.

- Revenue Growth Moderation: Although YoY growth remains robust at 94%, it has slowed from the 265% growth seen in prior quarters.

Diversified Business Segments

-

- Gaming: Revenue reached $3.28 billion, up from expectations of $3.03 billion, driven by:

- Increased GPU demand for PCs, laptops, and game consoles like the Nintendo Switch.

- Automotive: Revenue grew 72% YoY to $449 million, attributed to demand for self-driving car chips.

- Professional Visualization: Revenue rose 17% YoY to $486 million, fueled by growth in high-performance computing applications.

- Gaming: Revenue reached $3.28 billion, up from expectations of $3.03 billion, driven by:

Key Management Commentary

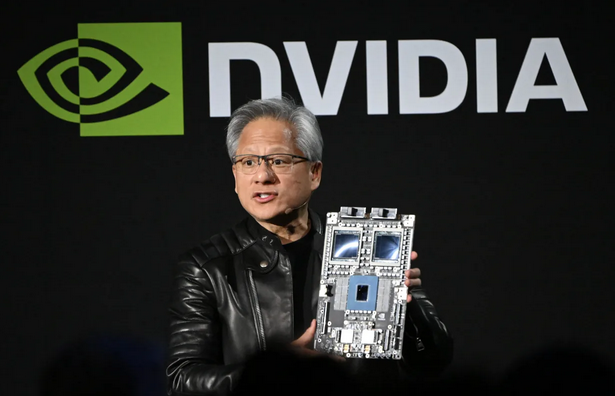

- CEO Jensen Huang:

- Called the AI era a “global shift to Nvidia computing.”

- Highlighted Blackwell’s full production and its availability to major partners for data center scaling.

- CFO Colette Kress:

- Confirmed shipment of 13,000 Blackwell chip samples to customers.

- Anticipated “several billion dollars” in revenue from Blackwell by Q4 FY2024.

Market Sentiment and Stock Performance

-

- Despite strong financial results, Nvidia’s stock dipped 2-3% in extended trading, reflecting investor caution over supply constraints and growth moderation.

- Nvidia shares have surged 195% in 2024, positioning it as a key player in the AI boom.

Outlook and Strategic Positioning

- Nvidia remains at the forefront of the AI revolution, leveraging its dominance in data center AI chips.

- Challenges like supply limitations and moderate growth forecasts are viewed as temporary, with analysts expressing confidence in Nvidia’s long-term leadership in AI technologies.

About Nvidia

Nvidia Corporation is a leading technology company specializing in graphics processing units (GPUs), artificial intelligence (AI), and data center solutions. Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia is headquartered in Santa Clara, California.

Core Business Areas

- Graphics Processing Units (GPUs):

- Nvidia is best known for its GeForce GPUs, which revolutionized gaming and 3D rendering.

- GPUs are now widely used beyond gaming, supporting AI, machine learning, and scientific computing.

- Artificial Intelligence and Data Centers:

- Nvidia is a pioneer in AI computing, powering applications like large language models, generative AI, and neural networks.

- Its Hopper and Blackwell AI platforms enable cutting-edge advancements in industries from healthcare to automotive.

- Gaming:

- Nvidia’s GPUs dominate the gaming market, offering unmatched performance for PC and console gaming.

- The company also powers consoles like the Nintendo Switch with its specialized chipsets.

- Automotive:

- Nvidia develops systems for autonomous driving, offering platforms like Nvidia Drive, which provide AI-based navigation and automation solutions.

- Professional Visualization:

-

- Solutions for industries like architecture, engineering, and entertainment, enabling high-quality rendering and simulations.

-

Key Innovations and Milestones

- CUDA (Compute Unified Device Architecture): Nvidia’s platform revolutionized parallel computing, unlocking GPU potential for non-graphics tasks.

- AI Revolution: Nvidia’s GPUs are critical for training AI models, making it a cornerstone of the ongoing AI boom.

- Omniverse: Nvidia’s platform for 3D design collaboration and digital twin simulations.

Market Leadership

- Nvidia is valued as one of the most important tech companies globally, particularly in the AI sector.

- Its stock has seen extraordinary growth, reflecting investor confidence in its leadership in gaming, AI, and data centers.

Vision

Jensen Huang, Nvidia’s CEO, has positioned the company at the forefront of the AI revolution, stating, “The age of AI is propelling a global shift to Nvidia computing.”

With continuous innovation and expansion into AI-driven solutions, Nvidia remains a transformative force across multiple industries.

All values, calculations and our content are based on our own assumptions /thoughts /information’s available on internet. Please consult with your financial advisor before making any investment decisions based on this article. Vijay Broadcast is not responsible for any Profits / Losses. Thank you for reading, and we look forward to sharing another interesting article with you soon!

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram