Earn Rs 15,000/Month! All You Need to Know About LIC’s Bima Sakhi Yojana

On Monday 12th December 2024, Prime Minister Narendra Modi launched the Bima Sakhi Yojana, an initiative by the state-run Life Insurance Corporation (LIC), aimed at enrolling 100,000 Bima Sakhi agents within the next 12 months to empower women financially.

Discover LIC’s Bima Sakhi Yojana, empowering women aged 18-70 with financial opportunities, stipends, and career growth in the insurance sector.

This scheme is intended for women aged 18 to 70 who have completed at least Class 10.

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram

Speaking at the launch event in Panipat, Modi highlighted that woman would lead the expansion of the insurance sector through this scheme. He pointed out that LIC agents can earn an average of Rs 15,000 per month, emphasizing the potential for women to create a strong impact in this field.

[ the_ad id="1832"]“The scheme will be instrumental in providing social security to every household,” Modi added.

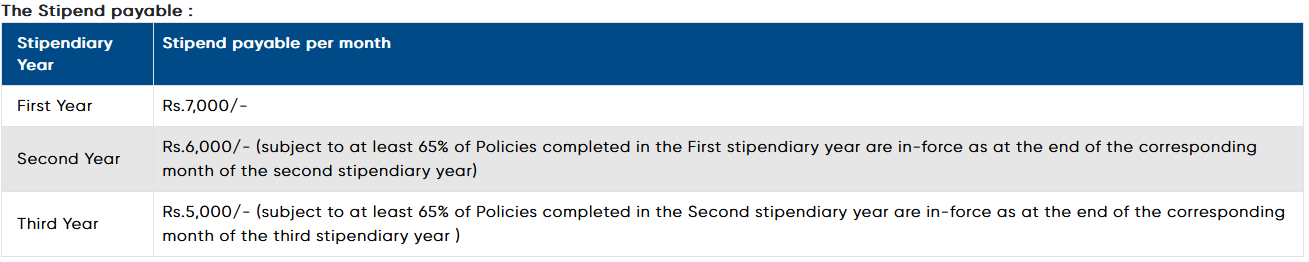

LIC plans to recruit 100,000 Bima Sakhi agents in the first year and 200,000 over the next three years as part of its broader women empowerment initiative. Finance Minister Nirmala Sitharaman, who attended the event, shared details of the plan, noting that 25,000 women who have passed Class 10 will be appointed as Bima Sakhi agents. These women will receive a stipend of Rs 7,000 in the first year, Rs 6,000 in the second year, and Rs 5,000 in the third year. Additionally, women aged 18-70 will be eligible to become Bima Sakhi agents. Following the completion of training and an exam, the women may qualify as permanent development agents under the guidance of the Insurance Regulatory and Development Authority of India (IRDAI).

READ MORE: Your Path to Financial Freedom: Maximize Returns with NPS Today

LIC Chairperson Siddhartha Mohanty stated that the corporation expects to spend Rs 840 crore on the Bima Sakhi Yojana in its first year, as part of its business expenditure. He expressed confidence that the premium income generated from the scheme would be four to five times greater than the initial investment.

The scheme’s goal is to have 200,000 women enrolled over three years, with a target of 100,000 in the first year. The women enrolled under the program will be tasked with selling an average of 24 policies per year and will be eligible for commission in addition to their stipend.

After completing three years of contractual work, the women will undergo further training, and following an exam, they could be selected as permanent agents of LIC.

READ MORE: How to Build a ₹1 Crore Education Fund for Your Child in 10 Years

These agents will be able to sell all LIC policies, though they are primarily expected to sell lower-value policies. The scheme’s focus is on reaching underserved regions and ensuring that at least one agent is enrolled in every panchayat area.

Recent regulatory changes, such as the potential for 100% foreign direct investment in the insurance sector, may impact the ecosystem. However, Mohanty expressed confidence that LIC would retain its market share. In the first half of the financial year, LIC’s market share grew to 61.07%, up from 58.50% in the same period the previous year.

READ MORE: 20 Factors to Consider Before Investing in Mutual Funds

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram