Identical Brains Studios IPO: Key Dates, Objectives, and Investment Insights

Identical Brains Studios Limited, established in 2019, specializes in cutting-edge VFX services for films, TV, web series, and commercials. Its robust financial growth and award-winning projects spotlight its industry leadership.

Discover Identical Brains Studios IPO details, key dates, objectives, and growth potential in India’s thriving VFX market. Secure your stake in this ₹19.95 Cr SME IPO.

IPO Details:

- Type: SME IPO

- Equity Shares Offered: 3,694,000 shares

- Face Value: ₹10 per share

- Total Issue Size: ₹19.95 Crores

- Price Band: ₹51 to ₹54 per share

- Minimum Order Quantity: 2,000 shares

Key Dates:

- Opening Date: December 18, 2024

- Closing Date: December 20, 2024

Investors interested in participating in this SME IPO can bid within the specified price band, with a minimum application size of 2,000 shares. The offering is expected to draw attention from retail and institutional investors due to its focus on the growing VFX industry.

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram

Achievements in VFX:

- Award-Winning Projects:

- Scam 1992: The Harshad Mehta Story (2020): Won the Filmfare OTT Award for Best Visual Effects in collaboration with Variate Studios LLP.

- Rocket Boys (2022): Secured another Filmfare OTT Award for Best Visual Effects.

- Phone Bhoot (2022): Recognized with a Dadasaheb Phalke Award for Best Visual Effects.

- Notable Nominations:

- Their work has garnered nominations at prestigious events, including the Filmfare OTT Awards, the Filmfare Awards, and the Dadasaheb Phalke Awards, solidifying their reputation for excellence in VFX.

READ MORE: 20 Factors to Consider Before Investing in Mutual Funds

IPO Size and Structure:

- The IPO comprises a fresh issuance of 3.694 million equity shares at a face value of ₹10 each, utilizing the book-building route.

- The raised funds will be allocated to various strategic initiatives aimed at business expansion and infrastructure enhancement

Proceeds Utilization:

- Office Renovation: The company plans to revamp its existing office and studio located in Andheri, Mumbai, to enhance operational efficiency.

- Infrastructure Development:

- Establish a Color Grading Digital Intermediate and Sound Studio in Andheri for high-quality post-production work.

- Open a new branch office in Lucknow, signaling regional expansion and tapping into emerging markets.

- Purchase advanced computers, storage systems, and software to upgrade existing facilities and meet the growing demand for high-end VFX services.

- Working Capital and General Expenses: Funds will also cater to incremental working capital requirements and general corporate purposes.

- Business Focus and Market Position:

- Identical Brains Studios provides VFX services for various media, including films, TV series, web series, and advertisements.

- Notable clients include leading Bollywood studios and reputed content creators.

- The company has contributed to high-profile projects such as Rocket Boys, Scam 1992: The Harshad Mehta Story, Dream Girl 2, and Indian 2, among others.

READ MORE: How to Build a Rs 1 Crore Corpus: The 15/15/15 Rule of Mutual Fund Investing

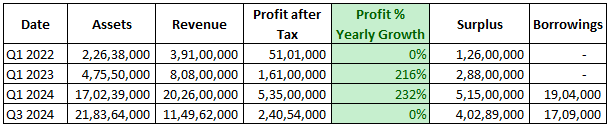

Financial Performance:

- Revenue grew significantly from ₹8.04 crore in FY23 to ₹20.08 crore in FY24, marking a 150% increase year-over-year.

- Profit after tax (PAT) saw a dramatic rise from ₹1.61 crore in FY23 to ₹5.34 crore in FY24.

Industry Context and Growth:

- The Indian VFX industry has witnessed explosive growth, with a compound annual growth rate (CAGR) of 82% from 2020 to 2023.

- Projections indicate further growth, with the market expected to reach INR 1494.8 crore by 2030. Identical Brains Studios is well-positioned to capitalize on this booming industry.

READ MORE: SIP Return Calculator – How to Calculate Your SIP Returns with Step-Up SIP & Types

IPO Management:

- Lead Manager: Socradamus Capital serves as the sole book-running lead manager for the IPO.

- Registrar: Bigshare Services Private Limited is the designated registrar for handling investor queries and allotments.

With remarkable achievements, strong financials, and a strategic focus on expansion, Identical Brains Studios’ IPO offers an attractive investment opportunity in India’s rapidly growing VFX industry.

Disclaimer: All values, calculations and our content are based on our own assumptions /thoughts /information’s available on internet. Please consult with your financial advisor before making any investment decisions based on this article. Vijay Broadcast is not responsible for any Profits / Losses. Thank you for reading, and we look forward to sharing another interesting article with you soon!

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on WhatsApp

Follow Vijay Broadcast on Instagram

Follow Vijay Broadcast on Instagram